Albanian Insurance Market Developments for year 2016

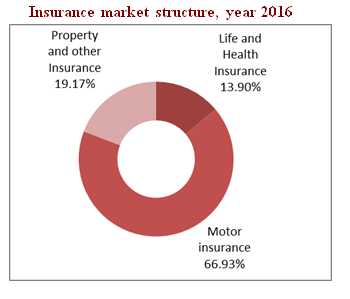

The insurance market reached about ALL 15,368 million for year 2016, or 9.09% more compared to the year 2015. During the year 2016, the number of issued insurance contracts reached 1,126,232 showing an increase of 2.66% compared to the year 2015. The market continued to be dominated by Non-Life insurance, which share was 93.09% of the total premium volume, Life insurance and Reinsurance market share was respectively 6.36% and 0.55% of the total premium volume. Market shares of voluntary and compulsory insurance gross written premiums were respectively 37.81% and 62.19%.

The total of paid claims during the year 2016 was about ALL 4,245 million or 16.68% more, compared to the year 2015.

Compulsory Motor Insurance

During the year 2016, the Compulsory Motor insurance premiums were about ALL 9,506 million, showing an increase by 12.15% compared to the year 2015.

Gross written premiums in Domestic MTPL insurance, increased by 11.57% in the year 2016 compared to the year 2015, also the number of insurance contracts increased by 4.22% compared to the same in the previous year.

Gross written premiums in Border insurance, for the year 2016 increased by 19.32% compared to the year 2015. The number of contracts also increased by 21.86% compared to the same in the previous year.

Gross written premiums in Green Card insurance, increased by 12.20% in the year 2016 compared to the year 2015. The number of contracts also increased by 15.26% compared to the same in the previous year.

Voluntary Insurance

Voluntary insurance premiums for the year 2016 were over ALL 5,778 million or 3.20% more than the same last year. The number of insurance contracts decreased by 3.10 % compared to the year 2015.

Non-Life voluntary insurance during the year 2016 experienced an increase by 5.01% compared to the same last year.

During the reporting year, 2016, the total revenues in the portfolios of property, Liability and Guarantee insurance, were about ALL 2,558 million. The biggest share of this portfolio, with 73.56%, was taken by Fire and other Property Damage insurance, followed by General Liability insurance with about 17.10%.

Gross written premiums in Insurance Against Fire and Natural Forces portfolio, during the year 2016 decreased by 11.13% compared to the same last year. The number of contracts increased by 14.87% compared to year 2016.

Gross written premium volume in Accidents and Health insurance was about ALL 1,146 million in the year 2016, experiencing an increase by 2.44% compared to the same last year.

Life insurance premiums for the year 2016 reached over ALL 978 million or 4.83% less than the year 2015.

Gross Paid Claims

Payment of claims, during the year 2016, increased by 16.68% compared to the year 2015. Most of the gross paid claims were related to Motor insurance, over ALL 2,608 million or 61.45% of total gross paid claims.

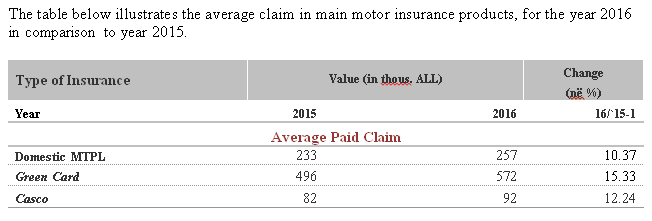

The table below illustrates the average claim in main motor insurance products, for the year 2016 in comparison to year 2015.

|

Type of Insurance |

Value (in thous. ALL) |

Change |

|

|

(në %) |

|||

|

Year |

2015 |

2016 |

16/`15-1 |

|

Average Paid Claim |

|||

|

Domestic MTPL |

233 |

257 |

10.37 |

|

Green Card |

496 |

572 |

15.33 |

|

Casco |

82 |

92 |

12.24 |

For further detailed information, the Monthly Statistical Report, for the year 2016, contains detailed tables and charts on the division of the insurance market by type of insurance, insurance product, insurance company share, etc.

To read the full material for the year 2016 monthly statistical report (in Excel version), please click here.

English

English Shqip

Shqip